Taxation Advice & Compliance

Income Tax

Personal Taxes (Residents or Non-Resident for Tax Purposes)

As an Australian Resident for tax purposes, you will have to report your income from all sources, both inside and outside Australia. Whilst for a non-resident, you will only be taxed on an Australian Sourced Income (e.g. Real Property in Australia). The deadline for most individuals to file their tax returns and to pay any taxes owing is 31 October or 15 may if you use a registered tax-agent.

At Intelligent Accounting & Tax Services, we will help identify areas where taxes paid can be reduced or minimised by claiming applicable:

- Employment expenses

- Education deductions

- Any tax-credit/offsets you are eligible for

- Gift or donations to organisational status that have the status of deductible gift recipient (DGRS)

- Medical expenses

- Superannuation contributions either as an employee or as a self-employed

- Many other applicable tax credits

- Home Office Expenses

- Vehicle/Travel Expenses

- Losses from previous years, investment related deductions and other specific income deductions.

Business/Corporate Taxes

Australian resident companies have to file a corporate income tax return every tax year even if there is no tax payable. This includes:

- Non-profit organizations

- Tax-exempt corporations

- Inactive corporations

A company is a resident of Australia if it is incorporated in Australia, or although not incorporated in Australia it carries on business in Australia and has either:

- Its central management and control in Australia.

- Its voting power controlled by shareholders who are residents of Australia.

Some overseas investors may prefer to set up a Permanent establishment (PE), also known as a branch to incorporating a company or a subsidiary in Australia for a number of reasons. For example: to consolidate the financial results of the company in the place of residence of the overseas company.

The tax treatment depends on whether the PE is a resident of a country that has a tax treaty with Australia or not.

Capital Gains Tax & Fringe Benefits Taxes

Capital Gains Tax (CGT)

We offer specialised services to manage all taxation requirements related to the sale of your investment home/property, shares, Cryptocurrencies, units in the Exhcange Traded Funds (EFF), and many other CGT assets, ensuring minimal taxes are paid and complying with taxation law, Our comprehensives services includes CGT calculation, Tax Planning and Strategy, CGT Exemptions and Discount and advise on the records keeping and documentation. It is very important to ensure you maintain all necessary records. This ensures the information is readily available if you are audited by the ATO.

By leveraging our expertise at IATAX, you can confidently navigate the complexities of CGT and achieve minimal tax liability and maxumum financial results.

Fringe Benefits Tax (FBT)

A fringe benefit was introduced on 1 July 1986. This legislation was introduced to address revenue leakage related to non-cash benefits provided by employers to employees, which were previously not captured under the income tax system. The legislation ensures that any non-cash benefits provided by employers to employees are appropriately taxed.

There are many categories of fringe benefits; the most common ones are car fringe benefits, loan fringe benefits, expense payment fringe benefits, car parking fringe benefits, property fringe benefits, and so on. It is important to seek advice from our tax advisors to determine whether any non-cash benefits provided to your employees are subject to FBT and whether any benefits are exempt and any available concessions.

It is also important to understand the interaction of FBT with income tax and GST as a result of providing fringe benefits. For example, if you provide meal entertainment fringe benefits to your employees, it is subject to FBT. However, you would be entitled to claim the GST on the provided benefits, including the FBT payable, and it is tax deductible

Start up Entity Set-up and Business Structuring as you move through different stages of your business lifecycle

Your business might be outgrowing its current structure, or your goals might have changed. Sometimes it's clear that a restructure is needed, but other times it isn't. That's why it's important to review your structure regularly.

What’s the right structure? There's no one-size-fits-all answer. The best structure for your business depends on its unique characteristics. What's ideal will vary based on the specifics and goals of the business and its owners.

To determine the best structure for a client, we start with a fresh approach and design a customised structure based on their unique circumstances. In doing so, we generally consider aspects such as tax outcomes, asset protection, and whether it would affect your serviceability, which may require interaction with other lending specialists, cost of operating the structure, compliance costs, and succession or exit planning.

An example of a common entity structure is a trust business structure. With unexpected events in life, we are here to help you effectively tax plan and manage your personal or business assets for both current and future generations. Trusts are legal entities commonly created to minimise future gifting of assets and estate taxes. We are here to help you protect your assets, strategically plan to transfer your assets, minimise tax burdens, and assist in making distributions and gifts.

An example of a common an entity structure is a trust. With unexpected events in life, we are here to help you effectively tax plan and manage your personal assets or business for both current and future generations. Trusts are legal entities and are commonly created to minimise future gifting of assets and estate taxes. We are here to help you protect your assets, strategically plan to transfer your assets, minimise tax burdens, and assist in making distributions and gifts.

GST/BAS lodgement including Fuel tax credits

By partnering with us, you can rest assured that all aspects of your GST obligations are expertly managed, allowing you to focus on growing your business. Our goal is to simplify GST compliance, minimise your tax burden, and provide peace of mind knowing that your GST affairs are in capable hands.

BAS lodgement due date

If your GST turnover is less than $20 million and the ATO has not told you to report GST monthly, you can report and pay GST quarterly.

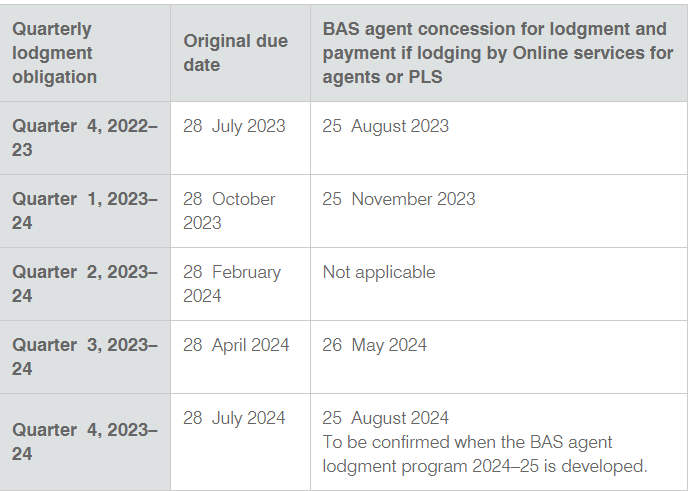

If we lodge BAS on your behalf, the due date for the quarterly lodgment obligation is summarised below.