There are several factors that may affect the lodgement due dates for individuals and trusts:

- Lodgment and compliance history: If you prior year tax return was not lodged on time, or if you were prosecuted for non-lodgment of prior year tax returns, the due date is generally 31 October. But always refer to the ATO letter advising the applicable due date.

- Income: Large and medium trusts (with an annual income over $10 million) that were taxable in latest year lodged generally have a 31 January due date. However, if the trust was non-taxable in the latest year lodged, the due date is 28 February.

- New registrants: New registrants for medium and large trust’s due date is 28 February.

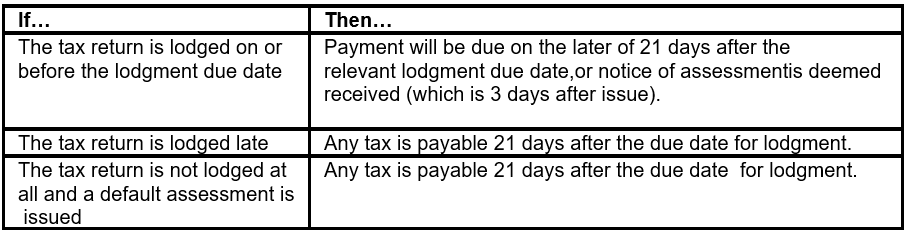

- Total Tax Liability: For individuals and trusts with a tax liability of $20,000 or more (excluding large and medium trusts), the due date for the lodgment is 31 March. However, the due dates for payments of individual and trust income tax assessments when the tax return due date is other than 15 May 2025 are outlined below.

For example: For example, Nicholas received a notice of assessment indicating a tax liability exceeding $20,000, which sets his lodgment due date as 31 March 2025. However, because he lodged his tax return on 1 October 2024, ahead of the due date, his payment date is 22 April 2025. This is calculated as 31 March 2025 plus 21 days, which brings it to 22 April 2025 as the 21 day is after the lodgment due date.

- Tax returns for all remaining individuals and trusts not required lodged earlier and not eligible for the 5 June concession, the due date is 15 May which is the most common due date of lodgment. For individual and trust clients with a 15 May lodgment deadline, staggered payment dates apply based on when their tax return is lodged and processed:

- Lodged by 12 February: Payment due 21 March

- Lodged between 13 February and 12 March: Payment due 21 April

- Lodged from 13 March: Payment due 5 June

The ATO doesn't penalise clients for lodging early, but the earlier you lodge, the sooner your payment due date arrives. This is because the ATO's system is designed to link payment deadlines with the timing of tax return lodgment and processing. If you lodge early, your return is processed sooner, leading to an earlier payment date. The due date of the payment can be found in the Notice of assessment (NOA) issued by the ATO.

The staggered payment system is in place to allow flexibility and manage workflow, but it can feel like a disadvantage for those who lodge early because their payment due date comes up faster compared to clients who lodge later. However, the benefit of early lodgment is that your tax obligations are finalised sooner, which can assist with financial planning. More importantly, your ATO’s period of review kicks in from the day the tax assessment is issued.

The ATO's period of review refers to the time frame during which the ATO can amend or review a tax return after it has been lodged. It kicks in from the day the tax assessment is issued (the date on the notice of assessment) and varies depending on the taxpayer's situation:

- For most individual and small business taxpayers: The period of review is generally two years from the date the assessment is issued.

- For more complex cases, such as large businesses or taxpayers involved in international transactions: The review period is typically four years.

- Fraud or evasion: There is no time limit if the ATO suspects fraud or evasion.

The review period applies to both original assessments and any subsequent amendments. Once the period of review expires, the ATO generally cannot amend the tax return unless certain exceptions (like fraud) apply.